Learn About 8 Important Basic Financial Concepts

1. Personal budget

2. Basic savings methods

3. Basic investment methods

4. Retirement planning

5. Building your credit

6. Primary loan types

7. Life insurance – whole life and term life

8. Planning for your children's college

Why I Created This

I have worked for many years in corporate America in a variety of financial management roles. Besides, I have also helped friends and family members over the years to review their finances and educate them on how to manage their money better.

More recently, I have been teaching my youngest son to start saving and investing his money and have since expanded that to his friend group - all young people in their early 20's. My daughter, who is 18, is extremely interested in learning from me and has said she wishes they taught the topics I cover here in high school.

There is no universal tool or information package that teaches you basic financial concepts in school, and not everyone learns this at home. There is a strong need for a package like this one. It takes potentially challenging basic financial concepts and breaks them down into small and easy to understand pieces.

As a result, I have prepared this information for the target audience range between 15 and 24 years old. Frankly, people of all ages who do not feel comfortable managing money, who don't realize the importance of saving for retirement (it is so Huge), who do not fully understand just how valuable a high credit score is and who perhaps have not thought about the future more broadly to appreciate life insurance's need and value. Anyone seeking an understanding of these things can significantly benefit from the information I have prepared here!

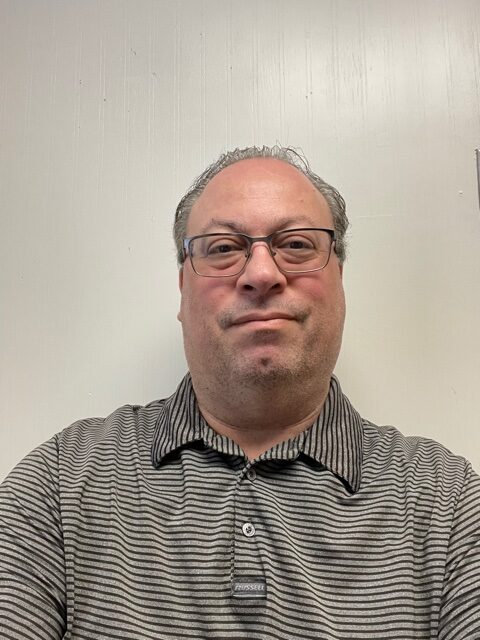

About Author/Teacher

I have been managing money since I got my first part-time job at age 13

At age 20, I paid $8,030.00 in cash for my first car and still had over $2,000.00 left

I have a bachelor's degree in Accounting

Over the past 30+ years, I have worked in Corporate America in a variety of financial roles

Managing budgets personally and professionally, has been a passion of mine. In the corporate world, I have managed expense budgets as large as $1Billion!

Learn more about me at www.clearcutconsultingllcdenj.com or on Linkedin http://linkedin.com/in/joel-forman-fff

Please Note This Information is Only Available in the US

Pay Yourself First - Save & Invest Your Money

It takes time to build wealth. The earlier you start, the sooner it can happen. It is a fantastic feeling to see your money grow over time. You all work hard for your money, so once you make it, put a good portion of it to work for you!

You need to develop a habit of paying yourself first. In this blueprint, I suggest how much money you should put aside for you and your future for every pay period!